Building a business is a journey. By working with us, we help entrepreneurs define a path forward to the next desired chapters of their lives.

The journey begins with two questions:

1. Where am I now?

2. What is my destination?

These two questions are often asked in the context of business valuation. For most business owners, the business is their most valuable asset whose future value forms the basis for achieving retirement and legacy goals.

But how is business value estimated?

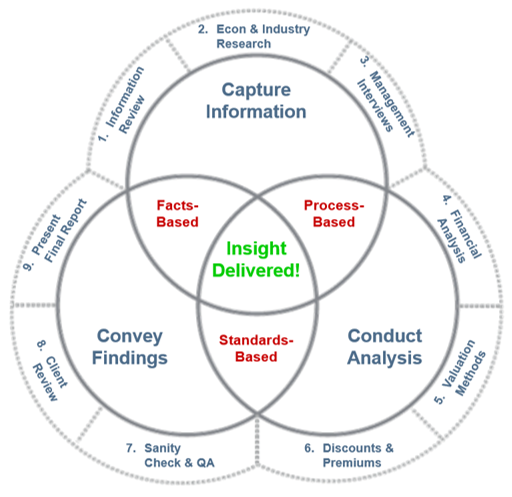

Generally accepted valuation methodology has been developed over several decades to estimate the value of

a business or business interest.

For over 20 years, the Principal of Sawtooth Valuation Advisory LLC has provided valuation guidance to business owners and executives for transactions, tax compliance and planning, and financial reporting purposes.

Our robust process, breadth of resources, and depth of expertise well equip us to guide you in finding the answers to your questions.

And you will benefit by gaining clarity of your current position and developing focus in pursuing your goals. This proactive approach will give you peace of mind and confidence knowing that you’re on the right path in your journey.

Financial assessments to evaluate debt structure and capital adequacy. Valuations for capital raises; minority buyouts; buy-sell agreements; and mergers, acquisitions, divestitures and joint ventures.

Outsourced financial planning and analysis (FP&A) services; financial model review, development and maintenance; strategy valuation; and exit option analysis. Valuation review services.

Valuations for estate/gift tax, charitable contributions, reasonable compensation, equity-linked compensation, corporate restructuring, and insolvency purposes.